1) “Plan D” management

Working in Asia can provide distinct advantages for those who aspire to lead global organisations. For one thing, you have to constantly deal with uncertainty and unpredictability. This is true for most of Asia – with Singapore being the striking exception. When I was growing up in India, electricity blackouts were common, so we learnt to have a power generator as backup, and have another backup for the backup. This instinctive ability to have a plan B, plan C, and plan D is really useful when you take on a global role in today’s volatile world.

2) Small costs, big scale

In Europe and the US, sneakers costing US$200 are common, but you can’t expect to sell a lot of these in emerging Asia. You have to learn to make money out of small ticket sizes. Look at Unilever in India; they have learnt to successfully sell shampoos in single-serve sachets rather than big bottles. Working in Asia helps you rethink your entire cost structure. It helps you think small in terms of costs, but big in terms of scale.

3) Glocal ketchup

Asia is a tremendously diverse region. If you work here, you understand that there are lots of differences across cultures. But if you examine closer, there is also much in common. I call this being “glocal”. Take ketchup for example – it’s not the same across the world. In some places, they like their ketchup sweet, and other places they like it sour. But everyone likes a ketchup bottle that is easy to pour. No one likes to whack the back of the bottle to force the ketchup out and risk spilling it on themselves! You have to identify what is common across the globe, and what you need to adapt for local markets.

4) Transparency of thinking

There are many advantages Asian managers possess. But the biggest challenge for managers in the region is speaking clearly about performance expectations and providing direct feedback to their staff. In Asian cultures, we tend to be more careful about giving harsh feedback, and some Westerners can misconstrue this as an absence of feedback. It is this gap in clarity of communication and transparency of thinking that is the biggest challenge to Asian managers succeeding globally.

5) The secret of being comfortable with other cultures

I know I look different from most people – especially in the West. I realised early in my career that if I’m not comfortable with myself, I couldn’t succeed. What makes me comfortable with other cultures, is that I’m comfortable with who I am, the way I look and my values. Remember that you are who you are because of what you do, and not where you come from. We should not worry too much about “Am I acting in a culturally appropriate way?” People will value you for your transparency, your decency and your sense of purpose.

6) Bad news? Take the elevator

I hate bad news and I really hate failure. But I know the only way to prevent failure is to welcome information about problems. You need the bad news, so you can do something about it. Never shoot the messenger. If you have good news for me, take the stairs. If you have bad news, take the elevator.

7) More than preventing mistakes

I found out that a bank in a foreign country was going bust, and that MasterCard had significant exposure. I was told that there was negligence on the part of a manager – that this guy had 'goofed up' and should be sacked. I spent four to five very tense days trying to figure out what went wrong. I came to the conclusion that I would not have been able to do anything different. This guy worked 24/7, even through Christmas, to manage this problem. Leadership is not just about preventing mistakes; it’s about what you do once you learn that there is a mistake. He had done everything in his power to mitigate the damage. Not only did I not sack him – I gave him a special bonus instead.

8) Make the tough call

As a leader, you will never have perfect information. At some point, you have to take the risk and make a decision. You need to have courage to be unpopular. That is why I so admire Lee Kuan Yew (the former Prime Minister of Singapore). He could listen to others and then make tough and unpopular decisions. He had the resilience to see through his decisions. At MasterCard I introduced a system that any request to headquarters not acted upon or responded to in two weeks would be automatically approved. It wasn’t about making popular decisions; it was about the right decision – so we could speed up the decision-making process.

Never shoot the messenger. If you have good news for me, take the stairs. If you have bad news, take the elevator.

9) Protect the innovators

We need to separate the innovators from others in the core-business, as the core business has a tendency to hold back the energy of the innovators. We have too many guys who can say “No” to their ideas. I want our people to instead say, “Yes, if...”

My job is to protect the innovators. We formed a new research and development group. Their job is to use the money that we have invested in them wisely, but I don’t want a business plan from these guys – I want to see results. And here’s the thing: if the innovators don’t give me two things that are commercially viable within two years, I will fire the lot of them and start again. Autonomy and accountability, they work like a charm.

10) Lessons from my dad

My dad could relate to anybody. A decorated general in the Indian army, he could talk as easily to his driver as to his peers. He was able to switch back and forth between different groups and he would do so effortlessly. I saw how he treated everybody with the same level of respect. I’ve tried to introduce this culture of openness and engagement at MasterCard. Today, the biggest pals I have at our head office are the guys that do the newspaper delivery. I chat with them every morning, talk about sports. They are also a great source of office gossip!

Emerging markets, mobile phones, and MasterCard

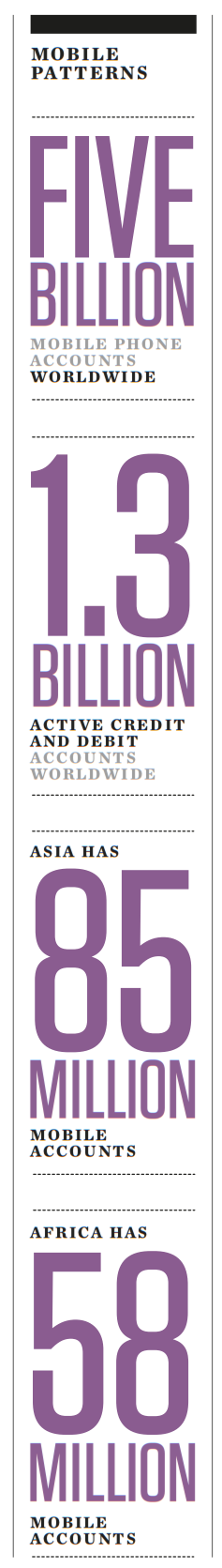

Around 85% of the world’s transactions are still carried out through cash and checks. However, there is large potential for growth in cashless transactions in both mobile accounts and emerging economies.

Developing economies in Asia, Africa, Latin America and the Middle East account for 25% of the world’s cashless transaction volume, and this is expected to double in the next five years.

Currently there are more mobile phones in underdeveloped economies than credit and debit cards, and these will play a crucial role in cashless transactions.

MasterCard is focusing on tie-ups with banks in Africa and Brazil, where mobile and card payments are on the rise. Today, MasterCard generates 60% of its revenues outside the US.

This article was first published in HQ Asia (Print) Issue 06 (2013)