The study collected survey responses from 606 Gen Y professionals and 616 managers across the industry – from banking, Islamic finance, insurance to capital markets. The research focuses on what young finance professionals expect from work, their attitudes and motivation, as well as their relationship with their managers. It also looked at how well managers understand Gen Y professionals who report to them.

Born between 1981 and 2001, Gen Ys are arriving on corporate doorsteps with a host of life experience as a direct result of early exposure to the internet, digital technologies and social media. They thrive on challenging work; enjoy collaborations; are independent; and have high expectations of themselves, their managers and the organisations they work for. Raised by parents who were very active in their upbringing, this generation is particularly independent-minded with high levels of confidence.

The study discovered that a majority of Gen Y finance professionals (78%) said that work had not lived up to their expectations and about 15% were dissatisfied with their managers at work. This may be because they have high initial career expectations and a desire to rise quickly to the top (about 44% of young professionals believed it reasonable for them to be in a management role within three years of starting work).Despite being discontented with their working life, young professionals are engaged at work. However, this is not translated into their long-term commitment at work as nearly half are likely to leave their current job within two years.

Findings also point to a significant disconnect between managers and Gen Y professionals across multiple issues. Gen Y professionals view working life far differently from their managers, who are mostly from Generation X. So, how can organisations and managers better engage with Gen Y? Studies have shown that organisations are able to better engage with Gen Y employees by addressing their expectations. Hence, the key to effectively manage Gen Y lies on how well managers know and understand their needs.

Mismatch in Work Expectations

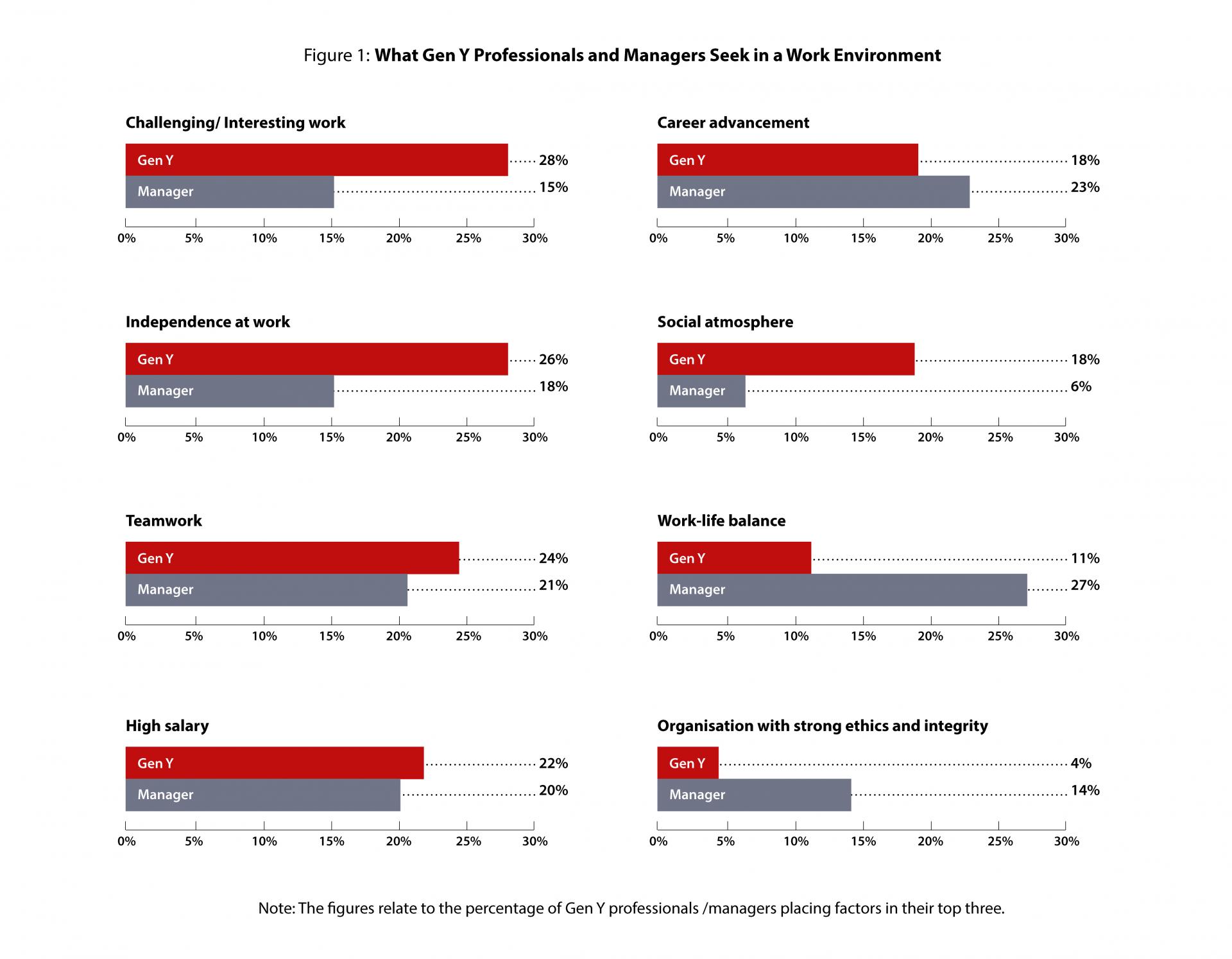

Gen Ys have considerably different expectations of their employment exper ience as compared to thei r predecessors. The top three priorities in the workplace for Gen Y professionals are: doing challenging and interesting work (28%), independence at work (26%) and teamwork (24%). Managers, on the other hand, see good work-life balance and career advancement as the most important workplace attributes. The desire that these young professionals have for stimulating and challenging work rather than a ‘job-for-life’ affects the way financial institutions build their talent pipeline. Interestingly, ethics was ranked very low by Gen Y. Only 4% of Gen Y professionals considered ethical organisations as an important element when seeking employment. Another interesting finding is that social connectedness is not a deal-breaker but a preferred work environment for many Gen Y professionals as only 19% ranked this as their top three most important element in a work environment. However, money still matters to them. When asked if they could improve one thing about work, remuneration was ranked as the most important consideration.

The key to effectively manage Gen Y lies on how well managers know and understand their needs and expectations at the workplace.

Out of Sync – Managers Don’t Seem to Understand Gen Y’s Values and Needs at Work

Gen Y is a social and inclusive generation that has been taught to collaborate and work with teams. As such, these young professionals are team-focused and place great importance on independence at work (ranked 2nd) and teamwork (ranked 3rd). However, their managers don’t think that they view either as important. Managers think Gen Ys rate these elements at 13th and 18th most important, respectively. But when it comes to ‘challenging and interesting work’, both are on the same page.

Dubbed ‘digital natives’ and a ‘connected generation’, Gen Ys place importance on staying connected with the rest of the world via social networks – within and beyond organisational boundaries. But managers don’t view social connections as important to young professionals (6th most important for Gen Ys, while managers think Gen Ys rate it 21st).

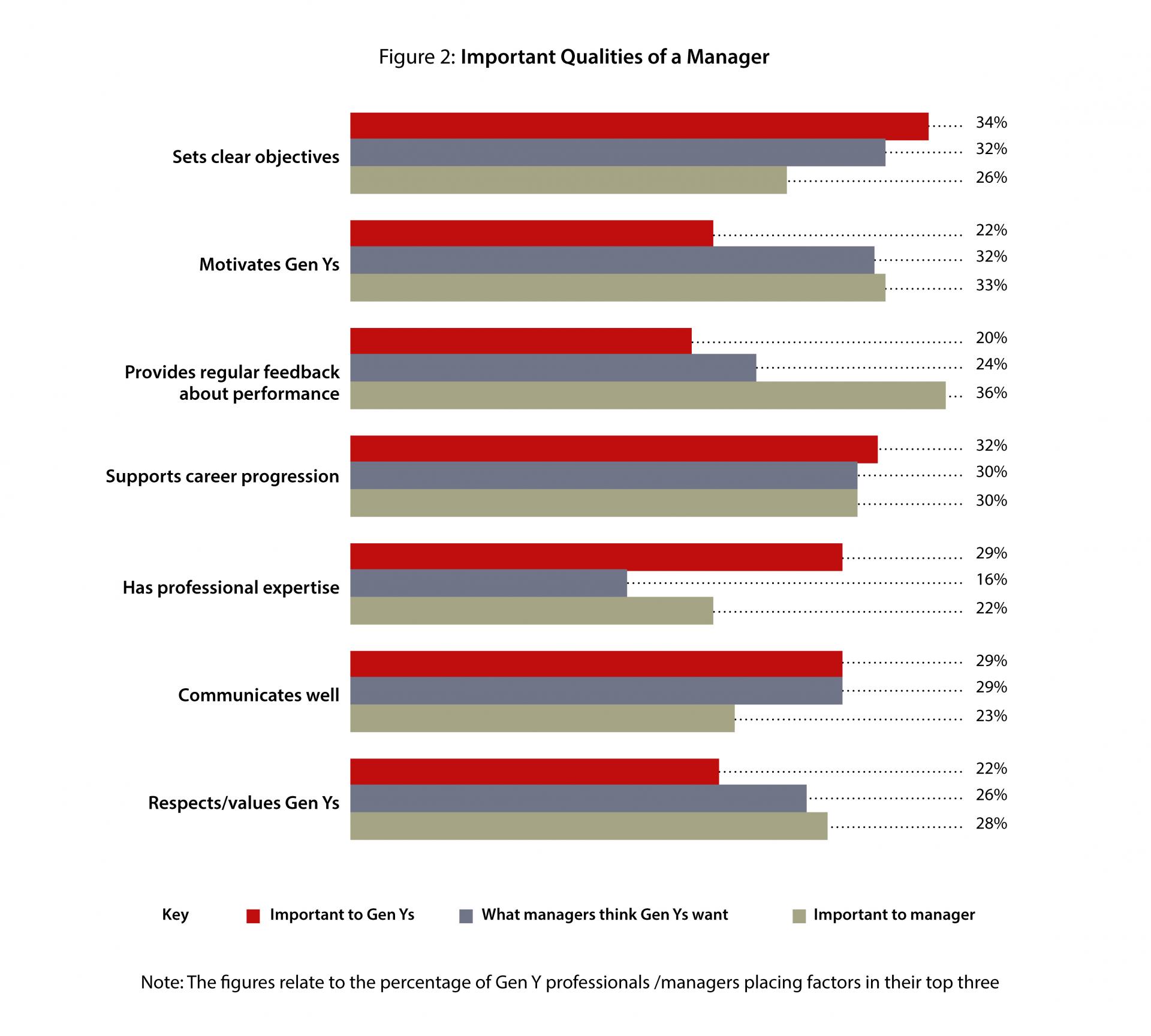

When it comes to important management behaviour, managers think that it is important for them to provide regular feedback on performance (36%) and motivate Gen Y professionals (33%). But these two factors are way down the list of Gen Ys’ needs at work, rating them at 7th and 8th out of 14 items. Young finance professionals seek managers who: set clear objectives (34%), supports their career progression (32%), communicates well (29%) and has professional expertise (29%).

Although managers recognise some of these needs, they don’t rate them highly as qualities of a good manager. However, both Gen Y professionals and managers agreed that it is important for managers to support career progression – Gen Ys placed this 2nd and managers rated it 3rd.

Different Lenses – Gen Ys and Managers View Their Relationships Differently

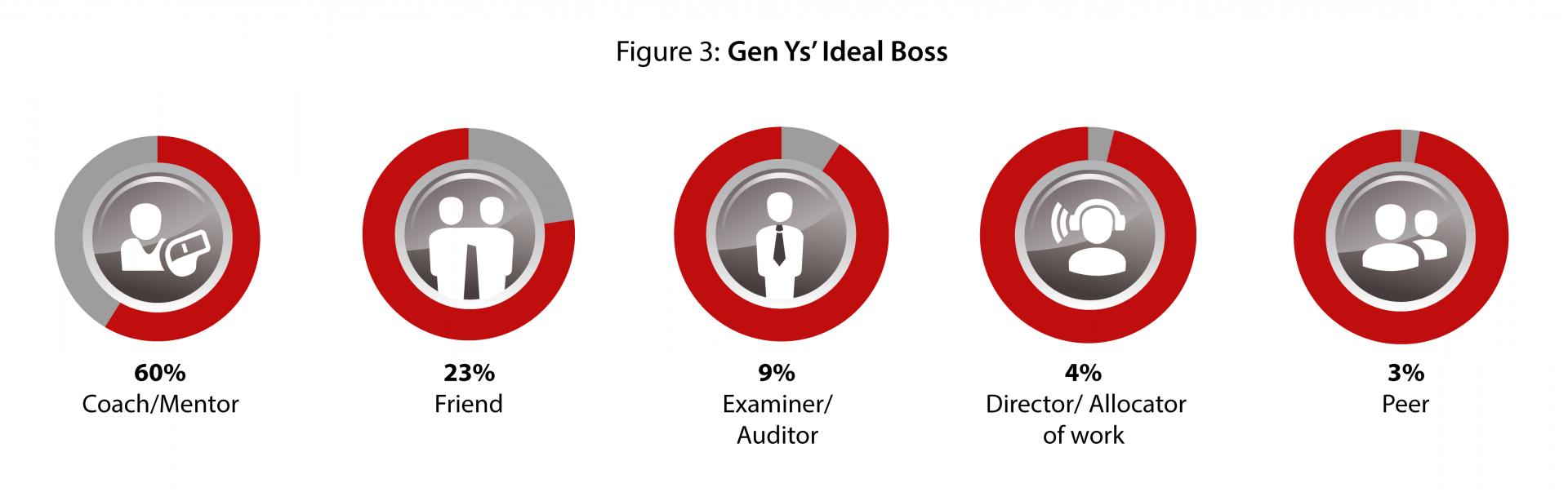

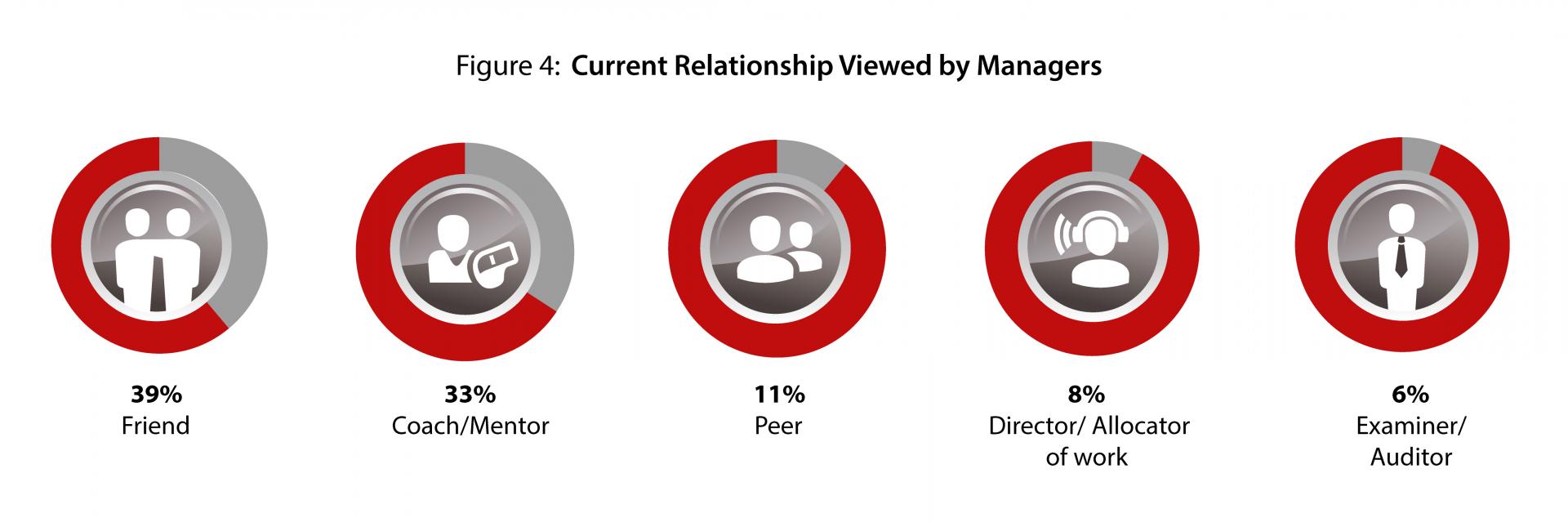

There is a lack of understanding between Gen Ys and managers when it comes to work relationships. According to Gen Ys, an ideal boss is a manager who fulfils the role of a coach or mentor. As a generation that is used to receiving hands-on guidance from parents and teachers, they see a leader as someone from whom they can learn and help them succeed. This implies that coaching and mentoring are important competencies for managers to demonstrate. While a majority of Gen Ys (60%) would like their managers to play the role of a coach, only 33% of managers see their relationship this way. Meanwhile, 23% of young professionals said they wanted their managers to be a friend, but a majority of managers (39%) believe that they are fulfilling this role.

Job-Hopping Behaviour – A Global Phenomenon

The research found evidence of high levels of engagement at work amongst young finance professionals. About 63% said they were willing to go above and beyond their duty at work, 70% are proud to work for their employer, 68% would recommend their employer as a good place to work and 64% are personally motivated to help their organisation succeed. But this high level of engagement was not translated into long-term commitment. An overwhelming 41% of young finance professionals say they only expect to be with their current employer for two years. Similar findings were reported in the UK, US, Middle East and India1.

This fits with other research findings that Gen Y professionals are comfortable with change and are willing to job-hop in order to gain experiences that resonate with their work desires – challenging work, independence at work, teamwork, salary, career advancement and social connections. To them, mobility is the key to effective career development. The findings provide several plausible insights. Firstly, the current retention strategies may be construed as not effective – which may imply that organisations need to revisit or revise their current approach to talent management. Secondly, in order for retention strategies to be effective, emphasis should be placed on the mobility aspirations of Gen Ys.

Greatest Gap in Career Progression

Gen Y professionals are said to be highly confident, ambitious and motivated individuals. Hence, they expect rapid career progression. The study found that 41% of Gen Y professionals surveyed believed they are ready for a management role within two years whilst 22% said within six months of starting work. Not only is this generation at ease about moving between jobs, they also want to move quickly in terms of career progression.

However, their managers believed that these young professionals have unrealistically high expectations in terms of career advancement due to a false sense of entitlement and an overinflated sense of their skills and abilities. Only 2% of managers agreed that Gen Ys are ready for a position in management within six months of working whilst a majority of them (60%) believed that young professionals will have to wait for another five years before assuming a management role.

This has huge implications on retention strategies. Gen Y professionals are clear and confident about their career progression and if organisations do not focus on developing leadership correctly, they will move to other organisations that are willing to provide them with bigger roles and responsibilities.

Conclusion

While the survey reports that Gen Y finance professionals are engaged at work and are satisfied with their current jobs, findings also suggest that they are concerned about career progression. Gen Y finance professionals want to be coached and not managed. Hence, the traditional command-and-control approach to management is no longer effective in retaining them. Organisations need to engage, enrich and empower them at work as well as provide them with a clear career plan that they can expect to grow in.