Over the past decade, we have been studying how great companies identify and develop talent, and connecting their actions to clear business outcomes. Our study, entitled Top Companies for Leaders, is probably the most comprehensive longitudinal study of talent management and leadership practices around the globe. We have conducted the study six times since 2002. This year, 470 companies participated, including 152 from the Asia-Pacific region, among which Aditya Birla, Hindustan Unilever, ICICI Bank and China Vanke head the 2011 list of Top Companies in Asia.

One question we are often asked is “How do they get there”? This year’s study sheds light on their success factors and what we can learn from them – the path forward for developing leadership capability.

The path forward: Building a strong leadership brand

Top companies believe that generating market value should guide leadership development activities. In fact, all successful programmes and initiatives for developing leadership talent at top companies are implemented to support important business needs. Because they fundamentally believe that talent drives value, human resource and leadership development actions are not simply aligned with the business strategy. Instead, their intention is to build a strong leadership brand. Other companies, in contrast, tend to focus on more generic leadership capability.

Leadership brand is a disciplined approach to building an integrated capability to sustain ongoing business results. Top companies develop a leadership brand by investing and aligning resources to:

1. Link the need for leadership to ability to deliver results, both now and in the future

2. Define leadership competency models specifically for their organisations and integrate their competency models in all phases of talent and leadership development

3. Assess both individual and organisational skills and experiences, evaluate the gaps, and create plans to close them

4. Invest to acquire, develop, promote, and retain critical talent more effectively and broadly by focusing on a few simple ideas and executing them well

5. Have business-based measures for the organisation, and hold leaders accountable for developing leadership capability, gauging progress on leadership initiatives, and assessing risk and vulnerabilities

6. Build a leadership brand and center their reputation on talent and leadership

These are the six elements of the path forward.

Top companies have a strong business case for leadership

All of the global top companies have articulated a clear business case for investing in leadership as a strategic imperative. While it is easy to say in rapidly growing markets that talent matters, it is more challenging to pinpoint how it matters and how a company will address the issue.

Nearly 85% of top companies say their leaders can explain how the investment in leadership affects financial performance, while only 54% of other firms in the study can say the same. In fact, 92% of top companies say their stakeholders understand how their leadership strategy creates value, compared to just 78% of all other organisations in the study.

Top companies are also more likely to have developed a strategy for individual leadership practices (selection, assessment, development, and succession) than other companies, and have explicitly aligned those practices to the overall business strategy and the leadership brand.

Linking leadership to business outcomes creates significantly higher levels of commitment to investing a leader’s most precious resource — time — directly on leadership activities. Executives who understand how leadership drives better business results will spend time on activities such as talent reviews, succession planning, coaching, creating development plans, leading education programmes, recruiting, or retaining critical talent. At every level and in every leadership activity, top companies have leaders who are more engaged in building leadership than other companies.

Top companies in the Asia-Pacific could improve significantly by having senior leaders more involved in identifying and developing talent. There are a number of examples from top companies that already do this. For example, Warwick White, Managing Director of Coca-Cola Amatil in Sydney, has personally trained over 400 executives over a three-year period. CEO Abdul Wahid bin Omar of Malaysia’s Maybank, sees employees as an extension of the bank’s brand to humanise financial services; to meet this goal, he conducts quarterly talent reviews and has 15% of his personal key performance indicators adjudged on talent development.

Top companies clearly articulate what a leader must know, be, and do

All top companies in Asia have a defined competency model that describes a unified theory of what leaders at their organisations should know, what they should be, and what they should do. In contrast, only 78% of the other companies in the region do the same.

Good competency models include more than just generic competencies.

Most companies have models or frameworks that describe what they expect of leaders. But, many of these leadership models are generic, stemming from the belief that leadership is leadership. But, when you take a customer-focused approach — the belief that a leader’s behaviour should be guided by what customers and other stakeholders expect — then certain expectations of leaders will be unique to a company, reinforcing the aspects that differentiate the firm in the marketplace.

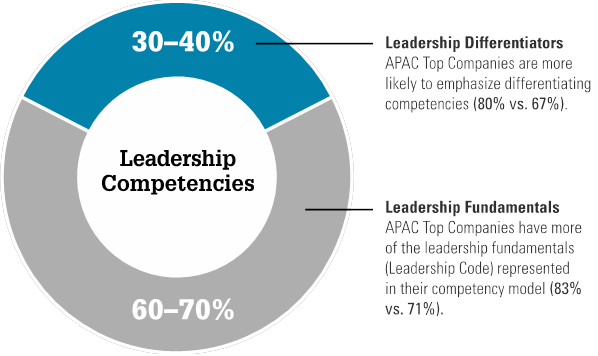

RBL’s meta-analysis of leadership models shows that 60 – 70% of Competencies are standard, while the 30 – 40% that are unique to each organisation, drive differentiation in leadership & thus business performance, as per illustrated below:

Top companies assess at both the individual and organisational levels

Top companies have a larger menu of assessment options (360 surveys and feedback forms, personality inventories, assessment centres, behavioural interviews, and simulations) for selection and development of leaders.

All top companies (versus 56% of other companies) assess leadership capability as part of their succession-planning process, allowing them to identify gaps and create organisational strategies to address critical shortages. Assessment is not just for individual development purposes at top companies, it is also an organisational diagnostic to address future organisational needs.

Top companies invest more and differently than other companies in building leadership capability

Top companies integrate leadership activities to create consistent expectations and results. They are much more likely to integrate their competency models into their internal selection process, performance reviews, base pay and bonus, external recruiting, development, succession and promotion, and long-term incentive plans.

Examples for such approach are GE’s Crotonville, IBM’s Corporate Services Corps, the Value Leaders awards at Aditya Birla, and talent panels and talent scouts at ICICI Bank in Mumbai. These programmes meet clear business needs to surface and accelerate the development of talent. But, their impact transcends their purpose. They become centrepieces, and the catalyst for broader and further-reaching initiatives. Their visibility and attention at the highest levels signal to others that to them, talent matters. And, in doing so, they extend the company brand around talent and leadership.

Top companies develop metrics for both the organisation and individual leaders

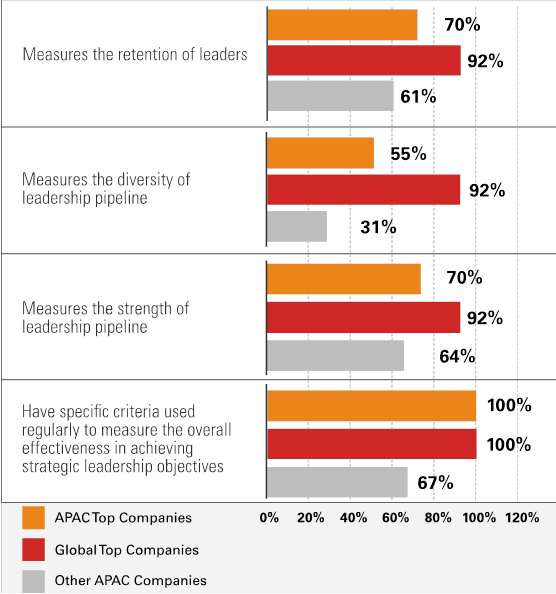

Top companies are more likely to have business-based measures for the organisation and to hold individual leaders accountable for developing other leaders. Nothing better characterises top companies’ disciplined approach to leadership and talent than their approach to metrics. As seen from the figure below, whilst even top companies have much to learn, particularly in the Asia-Pacific, they are more developed in this area than other companies.

The below chart illustrates organisational metrics used by top companies to measure effectiveness of leadership practices:

Top companies use measurement to gauge progress and hold leaders accountable

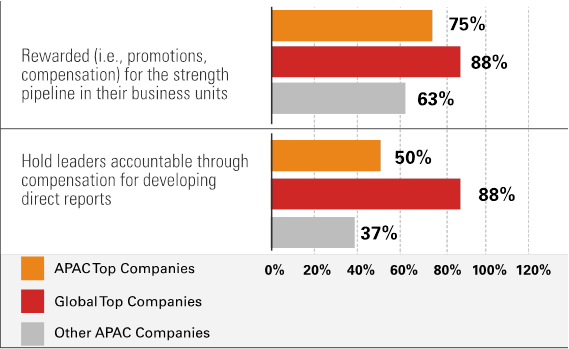

Leaders at top companies believe talent is important, and invest accordingly. They are, therefore, more likely to hold leaders accountable though compensation for developing their direct reports; leaders are also rewarded for the strength of their talent pipeline.

The below bar charts illustrates how top companies measure and hold leaders accountable for key metrics of talent development:

For example, at Bharti Airtel in New Delhi, heads of business units are evaluated on a talent development index that includes high performer attrition, diversity, how often talent moves to another unit, and critical position succession. ICICI Bank in Mumbai uses a leadership cover index to measure and track the depth of the leadership pipeline for top roles, with each critical person having two immediate successors.

Top companies intentionally promote their reputation as ‘factories for leadership’

Infosys receives well over one million applications annually, yet hires less than 1% of those that apply. By comparison, Harvard University admits 9% of its applicants. They note this fact on their website.

Since the leadership practices of top companies are firmly rooted in the belief that leadership creates value, they are more deliberate and systematic in communicating the results of these practices to both internal and external stakeholders. With that, they have built a strong reputation as ‘factories for leadership’.

Over the years, there has been much discussion of unique Asian leadership models. Our research reveals that both global and Asian top companies have a single global leadership competency model, and one global leadership brand. They do not customise the model to each region. This counter-intuitive insight is driven by the clarity around the leadership brand architecture and the necessity for a single global model to support it. Of course, how the leaders enact the behaviours in each market is context-dependent, and it is this ability or agility that stands them in good stead. The area that top companies customise more than others is in leadership development programmes; generally they use fewer off-the-shelf or standardised executive education programmes. They do not customise the model, but they do customise the programmes.

Overall the gaps between Asia region and global companies has decreased in most areas and this trend looks set to continue as the larger Asian companies increasingly work globally and compete for the same talent. However there are areas where Asian companies trail behind other leading companies. Most notably, we observed Asian companies are lagging in metrics and accountability for leadership, and in identifying and developing a diverse workforce.

Closing these gaps, could be the opportunity for Asian companies to differentiate themselves and appeal to the best talent from this highly competitive region. Let us hope that they take this opportunity.

This article was first published in HQ Asia (Print) Issue 03 (2012)