Mongolia is a resource-rich country on the cusp of economic growth. Driven by a mining boom and the simultaneous upward movement of global commodity prices, Mongolia is currently Asia’s second-fastest growing economy, behind Bhutan’s hydropower-driven development. Economic growth slowed last year to 12.3%, after moderating expansion in China – Mongolia’s biggest export market – curbed demand for coal exports.

This year, however, the International Monetary Fund projects Mongolia will grow by 15.7%. In contrast, other resource-rich countries such as Australia, Russia and Indonesia are expected to show growth figures of 3.3%, 3.6% and 6.2% respectively in 2013.

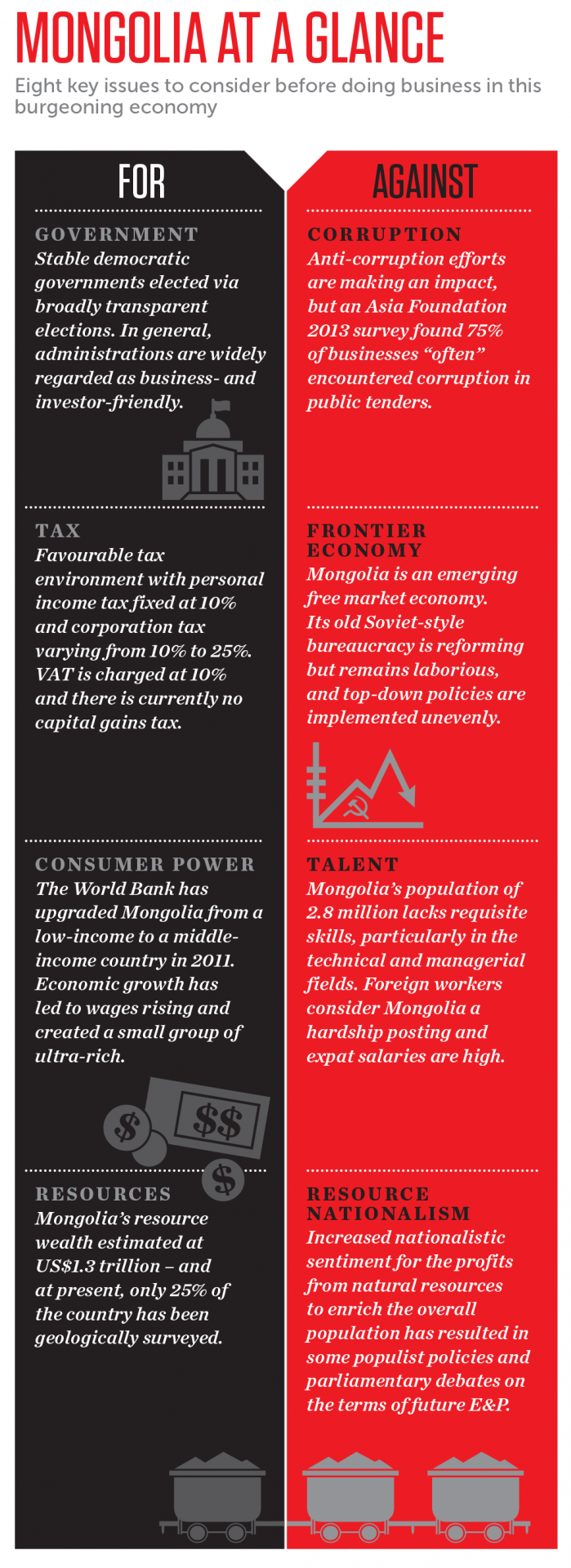

Click on image to enlarge.

Mining boom

This rampant growth is largely driven by foreign direct investment into the still largely untapped mining sector. “The country’s two largest mining projects, Oyu Tolgoi and Tavan Tolgoi, are expected to come online soon,” said Travis Hamilton, Managing Director at asset management consultancy Khan Investments Management. “This will be a game-changer.”

The Oyu Tolgoi copper-gold mine is expected to account for one-third of Mongolia’s GDP by 2020, estimated Rio Tinto, the British-Australian mining multinational that is building the mine. The Tavan Tolgoi deposit is predicted to be economically even bigger.

It harbours the world’s largest known deposit of coking coal, which is required to make steel. Mining operations at Tavan Tolgoi are expected to start in the next few years and should see Mongolian annual coal production increase from 16 million tonnes in 2012 to 40 million tonnes by 2020.

Mining operations require massive investment, and most exploration and production (E&P) companies turn to outside contractors for parts of their engineering, procurement and construction. There are opportunities for foreign specialists in several areas that revolve around the Mongolian mining sector, including recruitment, security, insurance and financing.

Market Opportunities

Outside of mining, infrastructure is another large-scale sector where foreign companies could offer consultancy, technological or other supporting solutions. At present, the Mongolian government seeks US$4 billion worth of investment in an industrial park development and nearby railway system, which will directly link Tavan Tolgoi to Mongolia’s major customers: China and Russia. It is also working to improve infrastructure in civic services and connectivity. In particular, there is heavy investment into transport networks: improving roads within Ulan Bator (also spelt “Ulaanbaatar”) and between the city and the provinces, as well as into the Mongolian rail system.

Mongolia also offers significant investment opportunities in sectors including agriculture, retail, hospitality, and banking and finance. There is an immediate need for technical expertise and easily applicable solutions to various sector-specific challenges, especially urban construction, light industry and food production.

Growing affluence has seen enterprises – from luxury brands to mass-market franchises – descend in force on Ulan Bator. Louis Vuitton opened a flagship store in the city’s central square, and KFC announced that it would open four outlets in Mongolia in 2013. This reflects the increased purchasing power of the country’s middle class and its ultra-rich, as well as its open market environment. “Average income doesn’t mean anything,” Louis Vuitton CEO Yves Carcelle told The Wall Street Journal. “What you need is a stable political environment and the necessary environment to put your store.”

Regardless of the sector, argued Hamilton, the key to successfully doing business in Mongolia is to have a trustworthy local partner. Due diligence and ensuring both partners have complementary goals and processes are essential. But a good local partner will bring an understanding of the local business environment, as well as a network within it, and is particularly useful when dealing with Mongolian administrative bodies, such as the tax authority or licensing agencies, which can be difficult to handle.

Challenges: Human capital, regulatory and infrastructure

Mongolia has a small population and rapid development. This combination, said the UN in their 2013 investment policy review of Mongolia, means that filling gaps in local knowledge and skills will determine what foreign direct investment the country attracts – and ultimately the long-term success of its economy. Despite a very high 97.4% literacy rate, the population generally lacks the skills needed by employers. Technical and managerial skills are largely absent, and over half the Mongolian workforce remains self-employed in agriculture.

Along with a lack of human capital is a major absence of infrastructure. Zanid Hussain is the author of a World Bank report on Mongolia’s infrastructure. He argues that the government has under-prioritised Ulan Bator’s infrastructure when allocating revenues, and that maintenance and upkeep have been grossly neglected countrywide. The result is that Mongolia ranks 112th out of 144 countries for overall infrastructure in the 2012-13 Global Competitiveness Report.

The Investment Policy Review reports that human capital and infrastructure issues – along with recently revised regulations governing the previously free market mining sector – have resulted in a ‘wait and see’ attitude amongst some investors.

The future

It has been 20 years since Mongolia began transforming itself from a socialist country to a free-market economy. Many economists regard Mongolia as having the potential to enrich both state and people through the country’s vast natural resources – but only if managed correctly.

Mongolia still suffers from an occasionally opaque political environment, talent gaps and infrastructure weakness. Mongolia ranks 94 out of 136 on Transparency International’s corruption perceptions index. This has improved, and the government is actively developing anti-graft bodies and processes, but opportunities for grand and administrative corruption remain.

However, the Mongolian government was elected largely on a platform of developing the country through foreign investment in the mining industry. Consequently, it has introduced legislation to make it easier for foreign companies to raise capital and conduct business, simplified legal and tax codes, and moved to ease foreign mining firms’ uncertainty surrounding mining regulations.

There are challenges and opportunities alike for doing business in Mongolia. With new wealth comes new opportunities, and consumer demand is going to increase. Mongolia does need foreign workers and companies that can make up for the shortage of skilled workers, but business-to-business opportunities will remain centred around the mining, construction and associated infrastructure sectors. Companies looking to enter the Mongolian marketplace should look for those sectors where they can offer processes or solutions to immediate challenges.

This article was first published in HQ Asia (Print) Issue 06 (2013)